LAST DEPTH

Highlights of KB STAR REIT

-

KB Financial Group’s first listed REIT through public offering

KB STAR REIT is the first publicly listed REIT by KB Financial Group

-

Leveraging KB Financial Group’s Network

KB STAR REIT will collaborate with KB Financial Group and global AMCs

-

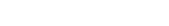

Incorporate local/global prime assets

KB STAR REIT will continuously endeavor to identify attractive assets backed by premier tenants

Stability

Stable office assets supported by premier tenants with long-term lease with 0% vacancy rate

-

Regie des Batiments

- Asset

- North Galaxy Towers(NGT)

- Credit ratings

- AA (S&P)

- Leasing period

- December 2004~November 2031(27 years)

- Early termination clause

- None

-

Samsung Electronics UK Ltd.

- Asset

- Samsung Europe HQ

- Credit ratings

- AA- (S&P)

- Leasing period

- December 2019~December 2039(20 years)

- Early termination clause

- After December 2034

-

Citibank Korea

- Asset

- Citibank Center(CBC)

- Credit ratings

- AAA(NICE Rating)

- Leasing period

- July 2005~February 2029(24 years)

- Early termination clause

- After December 2025(up to 5 floors)

KB STAR REIT links inflation to rent,

and dividends are expected to increase due to value-add strategy and disposal profits

-

North Galaxy Towers

North Galaxy Towers

Rent for NGT is linked to the increase of the Belgian CPI(Health Index) annually

-

Samsung Europe HQ

Samsung Europe HQ

Rent for Samsung Europe HQ reflects the annual Retail Price Index(RPI) increase of the UK on an accumulative basis for every 5 years accordingly

-

Citibank Center

Citibank Center

Potential for value-add utilizing the remaining Floor Area Ratio(FAR)

Preferred stock shareholders(KB STAR REIT) receive 45% of the disposal profit as dividends